Brexit. You can’t open a newspaper, website or WhatsApp group without hearing the word that has dominated the media agenda for almost four years.

However, though it has arguably been the most uttered word of the last half-decade, its long-term impacts are still not particularly clear. Numerous sectors – and, indeed, countries – are still unsure how the UK’s historic referendum is set to influence trade deals and economic prosperity going forward, but there are things that can be done to prepare, and there are elements that, though still somewhat muddy, are becoming a little clearer.

We are in a situation where, as Donald Rumsfeld once famously pondered, ‘there are known unknowns, and unknown unknowns’.

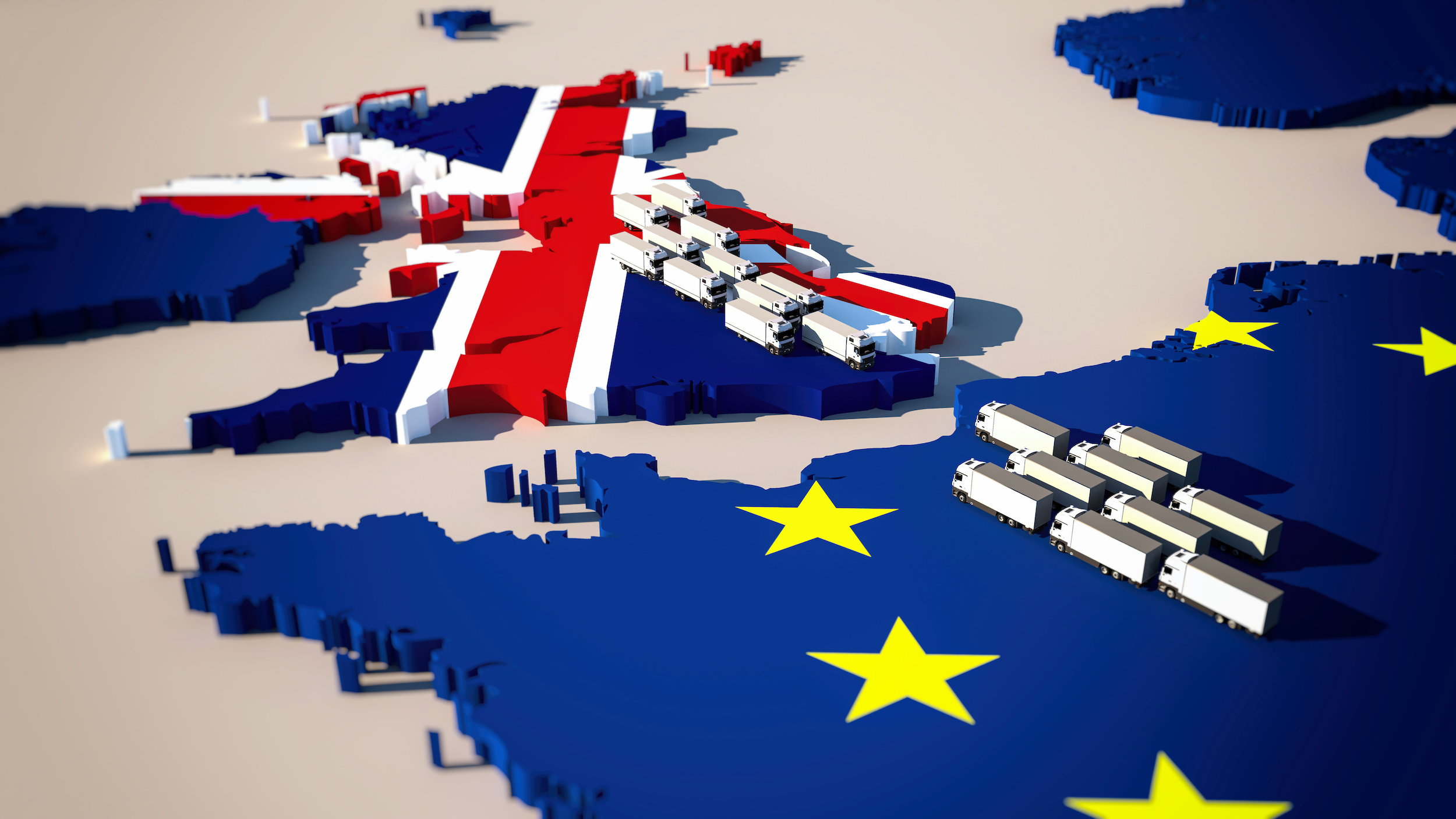

So, with that in mind, let’s take a look at what a no-deal Brexit could – and most likely would – mean for the road transportation industry and all associated logistics.

The scale of the issue

In 2016, a staggering 7.8 million tonnes of goods were transported between the UK and mainland Europe. Because of the EU’s freedom of movement – a central tenet of EU membership – these dealings were relatively straightforward, with simple pieces of documentation to sign and very few border checks.

However, with the UK now on the cusp of being entirely out of the EU (the UK is technically out already, but is still going through a transition stage), the situation is set to alter, and the international road transport sector will be at the forefront of this change.

Queues at Dover

One of the problems that have long been mooted since the prospect of a no-deal Brexit started to loom is that traffic will increase around ports, specifically Dover and Folkstone. Though the Government has suggested on various occasions that there will be no increase in queue size, advanced simulations are reporting something very different.

A simulation carried out by SIMUL8, a company with expertise in predicting trends and their associated outcomes, concluded that a 20-minute increase in check-in time due to increased border checks would see queue numbers expand from 1,000 trucks – the current average at peak time – to a whopping 70,594: a 70-fold increase. This would, undoubtedly, lead to huge congestion problems, and could even result in companies going bankrupt, or looking for alternative markets to sell into.

This would, undoubtedly, not be particularly good for the UK in the short-term, though in the long-term it could bring about additional opportunities.

The likely outcome

If such disruption is to be avoided, then it is inevitable the UK will have to invest heavily in enhancing its capacity to handle vehicles, prevent traffic jams, and create a streamlined process that will allow trade to occur smoothly and without hindrance.

Some experts have estimated that such an investment will likely require a financial injection of at least £60m from Government, while others believe that it could cost as much as double. As with so many Brexit-related things, this is, of course, speculation.

While much is still up in the air – a frustrating situation for businesses that rely on seamlessly dealing with their European neighbours – everything is liable to become much clearer in the coming months. However, this clarity is, given the current lack of development, unlikely to be positive initially. In fact, it is likely that things will get worse before they come close to getting better.